News articles following the deal commented that the term synergy typically involves closing offices, combining manufacturing facilities, and reducing the number of warehouses, which frequently means a reduction of staff and job losses. Synergies will come from the increased scale of the new organization, the sharing of best practices and cost reductions.” “The significant synergy potential includes an estimated $1.5 billion in annual cost savings implemented by the end of 2017. Examples of synergy in M&AĪ classic example of synergy in M&A is the merger of Kraft and Heinz, announced in 2015.Īccording to the press release from Heinz: Revenue enhancements are derived from the financial synergy that can be achieved by such things as cross-selling complementary products to customers, having more pricing power with consumers, and expanding or being able to enter into new markets and new geographical locations. Lastly, operational efficiencies may be realized by sharing best practices and streamlining processes across both companies. Bargaining power with suppliers can be improved because a larger company that places larger orders has more leverage and therefore the ability to negotiate better pricing and better payment terms.

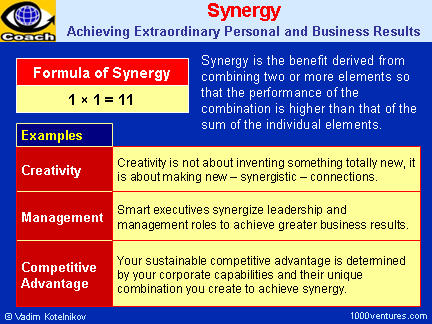

Redundant costs frequently relate to personnel, such as not requiring two CEOs and thus being able to eliminate one from the payroll. There are generally two types of synergy that can be achieved in an M&A process: (1) cost savings, and (2) revenue enhancements.Ĭost saving synergy – usually referred to as operational synergy – can be achieved by eliminating redundant costs, gaining better bargaining power with suppliers and vendors, and improving operational efficiencies. In other words, by combining two companies in a merger, the new company’s value will be greater than the sum of the values of each of the two companies being merged. This logic is typically a driving force behind mergers and acquisitions (M&A), where investment bankers and corporate executives often use synergy as a rationale for the deal. Synergy is the concept that the whole of an entity is worth more than the sum of the parts.

0 kommentar(er)

0 kommentar(er)